UOA REITs share price up in early trading despite lower Q2 net rental income 22072022 1123 AM KUALA LUMPUR July 22 Bernama -- UOA Real Estate Investment Trusts UOS REIT shares were up in the early trade despite its net rental income for the second quarter ended June 30 2022 Q2 FY2022 falling by 15 per cent to RM2172 million from. View daily weekly or monthly format back to when Uoa Real Estate Investment stock was issued.

90 day volume Average 235522.

. At the current price the counter is offering a distribution yield of 75 according to AbsolutelyStocks. Unbills sales only 101million. UOA Real Estate Investment Trust UOA REIT was constituted on the 28th November 2005 and was listed on the Main Board of Bursa Malaysia Securities Berhad on the 30th December 2005.

Discover historical prices for 5110KL stock on Yahoo Finance. Use the tab to select a relevant stock exchange depending on the stock you may prefer to view either NASDAQ stock prices or LSE share prices. UOA REIT 2Q rental income falls to RM2172 mil declares 4.

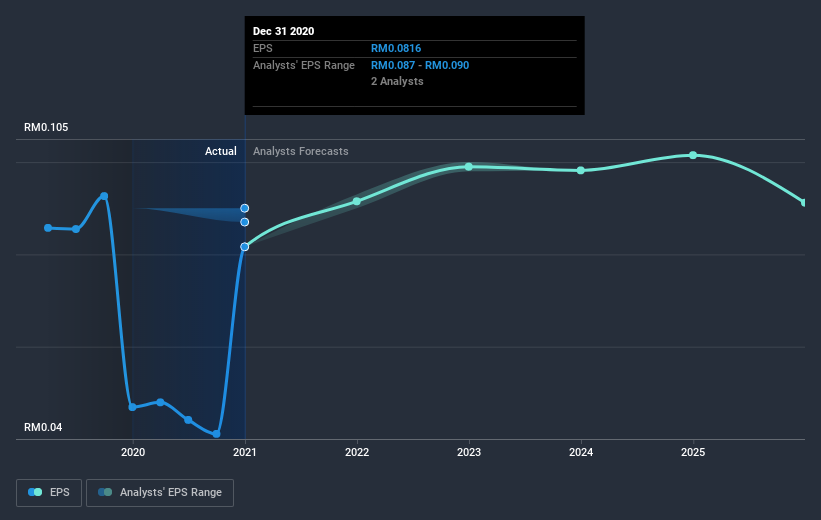

Total DebtTotal Equity Quarterly 6813. The current share price is 22 lower than NAV per share. Research Ratings UOA REIT 5110 Per-Share Earnings Actuals and Estimates.

Fundamentally good company but somehow the value is not reflect in the share price. UOA REIT and UOA Dev are part of UOA Ltd. Earnings per unit however rose to 223 sen in 2QFY22 up from 221 sen a year before.

UOA REIT and UOA Dev are part of UOA Ltd. 432 cents per share kenokaya 2021-07-22 1935. UOAREIT 5110KLSE announced the acquisition of UOA Corporate Tower at a price of RM700mil.

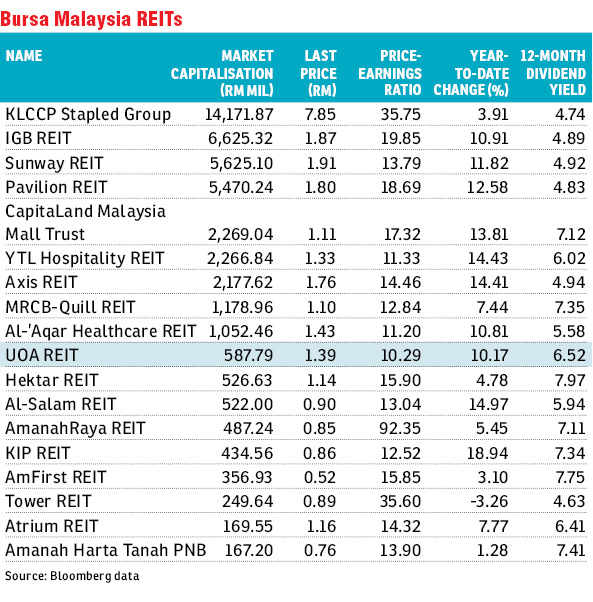

Over the last 3 years on average earnings per share has fallen by 11 per year whereas the companys share price has fallen by 6 per year. 20 day volume Average 446925. Like MRCB-QUILL Tower REIT AHP AMFIRST.

Its principal activity is to own and invest in real estate and real-estate related assets which are used or predominantly used for commercial purposes either directly or indirectly through the ownership of single purpose companies who wholly own real estate. Date Quarter Revenue PBT NP NP to SH Div Net Worth Div Payout NP Margin ROE NOSH RPS Adj. The acquisition is expected to be completed in 4Q2020.

The technical summary section provides an analysis as to whether UOA Real Estate Investment Trust stock is a buy or sell using real time data. UOA Real Estate Investment Trust UOA REIT was constituted on 28 November 2005 and was listed on the Main Board of Bursa Malaysia Securities Berhad on 30 December 2005. View historical data and performance charts.

Its dividend DY last year was around 8 pa but of late came down to 59. UOA REITs earnings are expected to improve greatly in FY21 backed by newly acquired asset UOA Corporate Tower in Dec 2020. 5 customer reviews 52 Weeks Range.

5110 Complete UOA REIT stock news by MarketWatch. Stock analysis for UOA Real Estate Investment Trust UOARBursa Malays including stock price stock chart company news key statistics fundamentals and company profile. View real-time stock prices and stock quotes for a full financial overview.

NAPS QoQ YoY EOQ Date EOQ Price EOQ PRPS EOQ PEPS EOQ PNAPS EOQ EY EOQ DY ANN Date ANN Price ANN. UOAREIT Share Price UOA REIT an investment holding company based in Malaysia deals in real estate business. Price of this share is now almost stagnant.

Actually quite a lot of UOA Ltd Investment Properties are actually in UOA Dev. UOAREIT 5110 Share Price. Per Share Item Performance Valuation End of Quarter Valuation Ann.

5 day volume Average 680880. Is the DRP a default or we can choose to have dividend in cash. But the ve suggesting a rising price trend on volume and -ve suggesting a falling price trend on volume indicators should give readers a better idea of what the market is buying and when to sell.

The investment objective of UOA REIT is to own and invest in real estate and real-estate related assets used or predominantly used for commercial purposes whether directly. Furthermore the office segment has been stable despite the Covid-19 pandemic. Like MRCB-QUILL Tower REIT AHP AMFIRST.

Actual Analyst Range Consensus. Revenue missed analyst estimates by 11. The acquisition is expected to be completed in 4Q2020.

UOA REIT focuses on investing in properties that are primarily used for office retail andor residential. The investment objective of UOA REIT is to own and invest in real estate and real-estate related assets used or predominantly used for commercial purposes. UOA Real Estate Investment Trust REIT unchanged at RM116.

The share price may move up or down from this point. Currently holding UOA REIT but the stock is on a downward trend. Also it has been consistently paying out more than 95 of its.

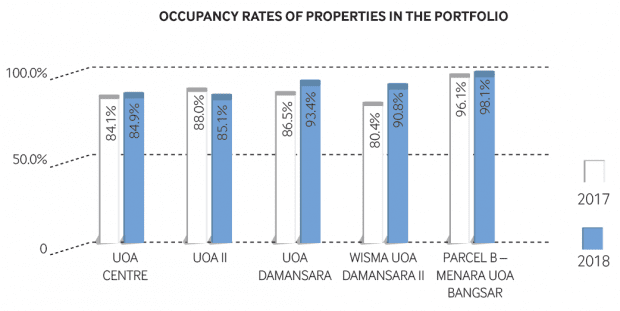

UOA REITs current portfolios occupancy rate is decent at 82. UOAREIT 5110KLSE announced the acquisition of UOA Corporate Tower at a price of RM700mil. 862 BM Reit Main Market Non-Shariah Compliant Property Investment and Management.

The plus factor of this shaire is that it gives dividends five times per. Earnings per share EPS also missed analyst estimates by 29. View the latest UOA REIT 5110 stock price news historical charts.

Price To Cash Flow Per Share TTM 1859. 26 Jan 2018 0628 PM Post 4.

Uoa Reit To Buy Corporate Tower For Rm700 M Us 168 23 M Reit Asiapac

Bernama Uoa Reit S Share Price Up In Early Trading Despite Lower Q2 Net Rental Income

Uoa Real Estate Investment Klse Uoareit Share Price News Analysis Simply Wall St

Uoa Real Estate Investment Trust Company Profile Stock Performance Earnings Pitchbook

Uoa Real Estate Investment Klse Uoareit Share Price News Analysis Simply Wall St

Uoa Reit S 4q To Remain Resilient On Strong Portfolio Occupancy

7 Things I Learned From The 2019 Uoa Reit Agm

7 Things I Learned From The 2019 Uoa Reit Agm

Uoa Reit In Acquisition Mode Edgeprop My

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

Uoa Reit In Acquisition Mode Edgeprop My

Is Uoa Ltd A Value Trap Part 1 Of 3

Uoa Reit 2q Rental Income Falls To Rm21 72 Mil Declares 4 3 Sen Distribution Income The Edge Markets

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Are Reits A Good Buy Now Edgeprop My